In 2019 the stock market reached an all time high. The Dow Jones Industrial average reached an all time high closing above 27,000 for the first time ever. The National unemployment rate hit 3.6% a 50 year low. Gas prices have remained low and the housing market has been booming. Despite all these great economic factors there has been a lot of talk about a recession.

Why are major media outlets talking about a recession?

It is no secret that people have been inaccurately predicting a recession for several years now. Recession talk has picked up rapidly as of late. The spread between the U.S. 2-year and 10-year yields on turned negative briefly for the first time since 2007. This has happened ahead of every U.S. recession of the last 50 years. It is also important to note that there have been times that this has happened and it wasn’t followed immediately by a recession. This indicator was gobbled up and spit out by the media though, making it seem like a recession was guaranteed to happen.

Are Recessions Self Fulfilling prophecies?

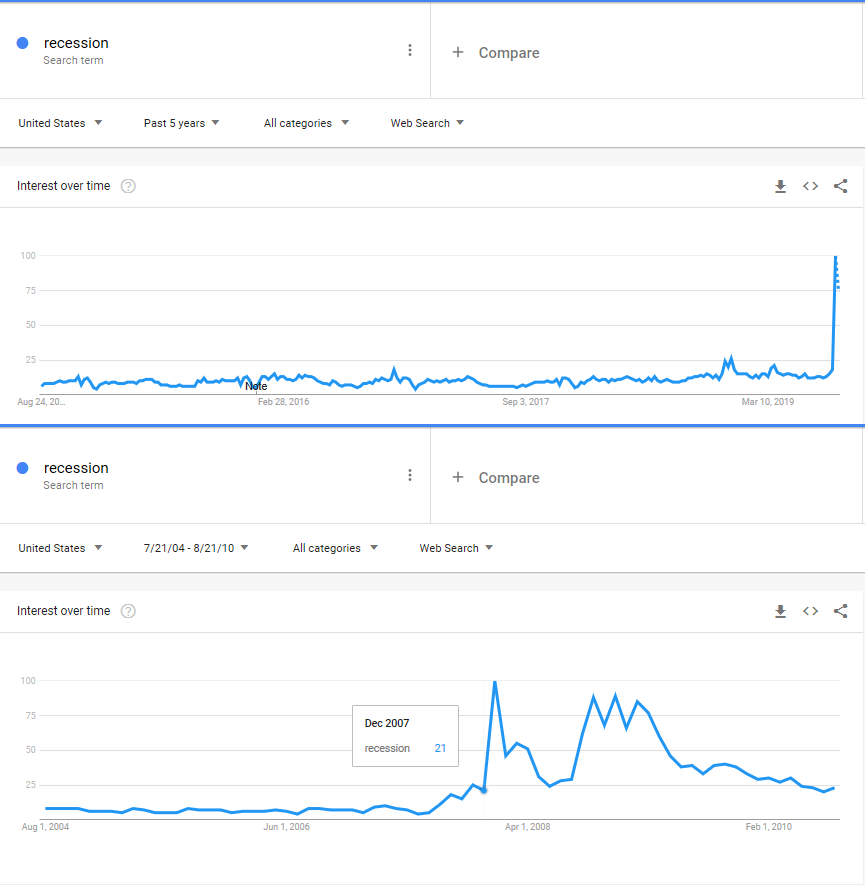

A lot of the US economy is based on belief and anticipation. Most stocks move based on where people believe they will be in the future. Does this same belief also have an impact on when a recession will take place? There is some evidence that supports that this may be the case. Below is a screen shot of Google Trends for the search term “recession”.

As you can see on the image above searches on Google increased significantly right before the start of the last recession in December of 2007. You can also see that the searches are increasing significantly over the last month. Is this just a coincidence? Did the average person just become an expert on predicting the recession in 2007 or did the media influence the general public to believe that a recession was going to happen?

Belief is powerful

These media companies know what they are doing. If they can make people believe something, they know they can create a ripple effect. If a person believes there is going to be a recession the first thing they are going to do is figure out a way to protect themselves or find a way to benefit from the recession. That is human nature. So if I am a stock market investor and want to “protect” myself from a recession one of the steps I may take, is to search on Google for “repression proof stocks”. Below is a screen shot of Google Trends for the search “repression proof stocks”

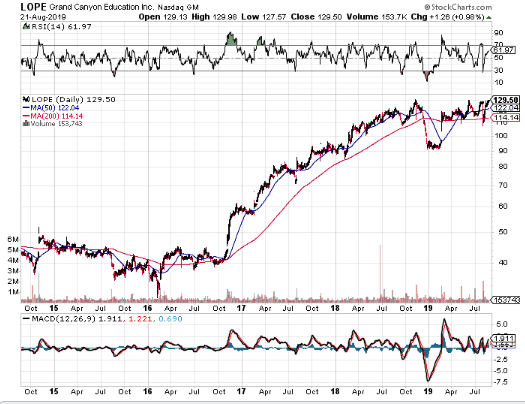

The first article that pops up on a Google search is Motley’s Fools 5 recession proof stocks. They list four very popular stocks Walmart, Altria (owns Marlboro), Johnson and Johnson, and Waste Management. Then on the bottom of their list they mention Grand Canyon Education Nasdaq:LOPE. I was reading the article and couldn’t figure out why they would lump LOPE in with all of these very popular Blue Chip stocks. If you take a look at the chart for LOPE it seems over bought. LOPE has went up over 300% over the last 3 years and seems like the exact opposite of the stock you would want to consider during a recession. It didn’t make sense to me.

I scrolled further down the article and I read this disclaimer:

“John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Brian Stoffel owns shares of Amazon. The Motley Fool owns shares of and recommends Amazon and Grand Canyon Education. The Motley Fool owns shares of Johnson & Johnson.“

Is this one of the ways the wealthy use the media to influence people’s beliefs and legally manipulate stock prices? Was this by design or just a coincidence?

Belief is powerful. If there is a strong media bias pointing towards a recession and people start to believe it, and they are more likely to sell the stocks they own. If a bunch of people start selling stocks so they can become cash heavy or so they can buy “recession proof stocks” , you will start to see stock prices fall. This selling creates more panic selling. Recessions are emotionally driven. There is a ripple effect. The questions is do we want to fight against this or do we want to follow the trend?

Disclaimer: Stocksnewswire.com and the Author Travis Garlick do not own any of the stocks mentioned in this article.