When I ask most investors or traders what they struggle with the most it is understanding SEC filings. You can search a company’s SEC filings by going here.

https://www.sec.gov/edgar/searchedgar/companysearch.html

SEC filings can be confusing at first but they are very important to understand. Since most people are busy and don’t have the time to read through pages after pages of filling information, it is important to find an efficient and fast way to locate important information.

Here are some of the most common forms you will see and a brief description of what they are.

- 10-k This is comprehensive annual report or yearly analysis of a company

- 10-Q This is an unaudited Quarterly report that updates the 10-k

- 20-F This is the financial report foreign countries must file if they trade on US exchanges since they don’t file a 10-k

- 8-k Report Filed announcing events investors should know about like both good and bad. This is where you will most likely find Authorized share increases or reverse splits announced. Also, acquisitions and company progress as well as company updates.

- PRE 14C Form PREC14C, “preliminary information statements – contested solicitations”, is required under Section 14(c) of the Securities Exchange Act of 1934. This form must be filed with the SEC 10 days before definitive information statements are distributed to shareholders and helps the SEC protect shareholders’ rights by ensuring that they receive key information, clearly presented. This form can give you a heads up about an upcoming Reverse Split.

- 13D This form reveals who owns the most of a company’s shares, Their background information, criminal history and the type of relationship the owner of the shares has to the company. It will explain why the transaction is taking place, what class of security, and where the money is coming from to make the purchase.

- Form 144 This is a notice of intent to sell restricted stock which us usually held by corporate insiders or affiliates that obtain the stock outside of a public offering.

- Form 3,4,5 Corporate insiders that own more than 10% of a stock must file special forms to obtain, buy, or sell shares of a company’s stock. These forms are used to notify investors when this happens.

- Form NT This is when the company won’t be needs an extension because they won’t be able to file a 10-Q or 10-K in time. This gives them an extra 15 days to file the 10-k and 10-Q and keep there current status. Often times you will see it as “NT 10-k” or “NT 10-q”These are just a few of some of the most common forms and fillings that you will see. You can find a full list of forms with a more detailed description at https://www.sec.gov/formsNow that you are familiar with what some of the forms and filings mean it is time to learn how to quickly look through some of these filings to find important information.

- Quickly looking at the 10-k and 10-Q

- First thing you want to do is locate the business summary.

This is where you will be able to find what the company does. I will describe the company’s operations, it will tell you about the company’s history, trademarks, patents, and marketing strategy. This is important to look at and decide is this something that has a good story and that would get investors excited. Most these companies never actually do what they say they will do. All they do is sell the dream to gullible new traders. This is where you decide is their vision is something that could get enough gullible greedy people excited. Below we pictured the growing concern which is something that is also important to locate. The going concern. Gives investors a good idea of future concerns the company has and what their plans are to fix those concerns. In this example the company makes it clear they will be selling shares to raise money as well as seeking debt financing which is another word for what we like to call toxic debt. This usually means the only way this stock is going up is if someone providing the company this debt financing has one of their buddies “coincidentally” pump or promote the stock. Technically they can’t know of any promotions of it is a SEC violation but these promoters and toxic financiers network and privately (secretly) take care of each other. - Quickly looking at the company’s balance sheet

In the example above you can see some important things highlighted in red.

A. This points out the spread sheet and finances has not been audited by a 3rd A lot of 10-Q won’t be audited. 10-K should definitely be audited. Never fully trust a financial statement that not audited by a third party! There are a lot of penny stock companies that will misrepresent numbers to sucker in investors. Always be cautious about unaudited financial reports.

B. This shows the total assets of the company

C. This is where you will find the Authorized shares and Outstanding shares for the company. This is far more accurate than just going by the information on OTCmarkets.com company profile. You still want to call up the Transfer Agent and verify these numbers to see if there have been any changes in share structure since the last filing.

Now the next thing is looking at the balance sheet, income statement, and cash flow statement.

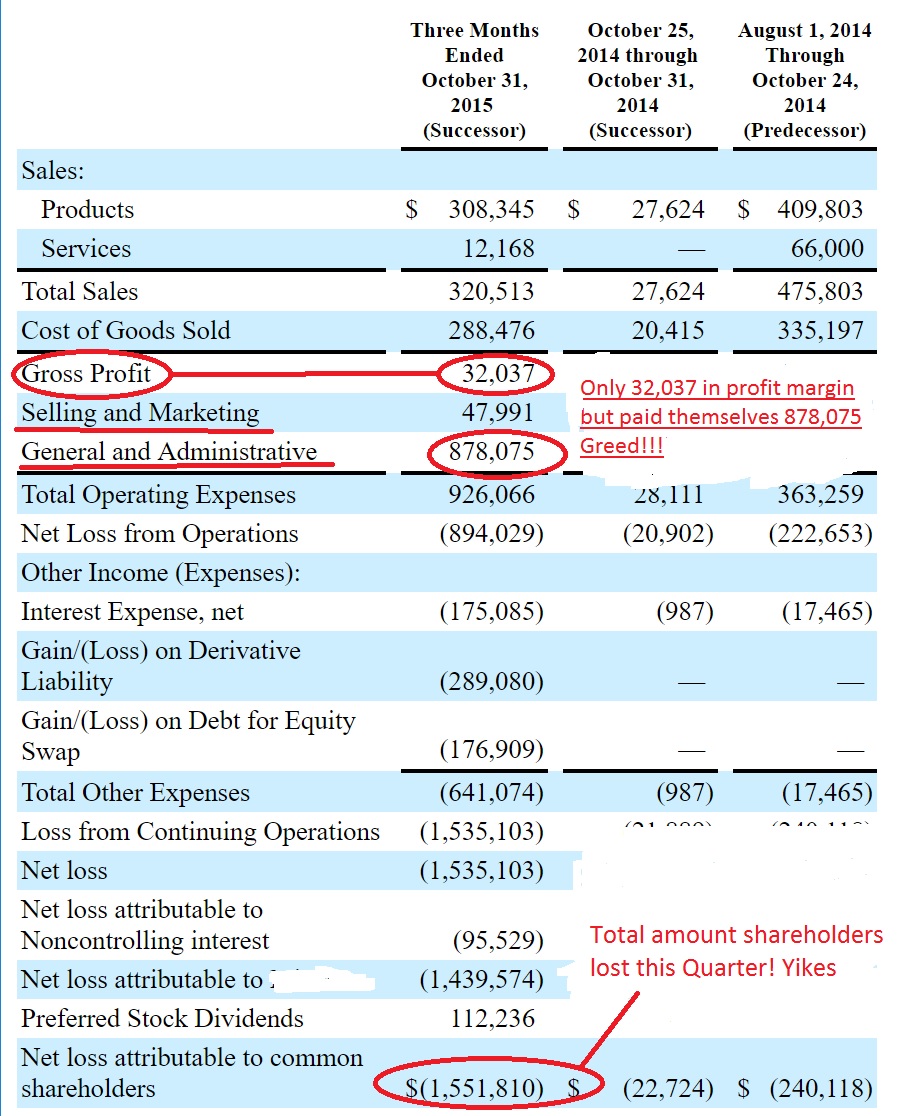

In the example, you can see some important things to locate on the balance sheet. You can see how much the company was making in sales. They sold $320,513 worth of goods but it cost them $288,476 to make those goods. That means that their gross profit margin is only $32,037. Now from the $32,037 you have to subtract the $47,991 the company spends to sell and market the product. So these geniuses in management found a product that they actually lose money on! It would be like me going to Walmart buying a bike for $100 then spending $50 on advertisement to sell that bike for $125. Each bike I sold I would be literally losing money on. That would be an awful business structure. It gets worse though. The company administration still paid themselves $878,075 dollars! How can they do this? Where is the money coming from? The money comes from Debt Financing also known as toxic debt. The toxic debt also comes with interest. The company will give shares away for money. This money they use to pay themselves. The lenders then will sell these shares once they become unrestricted.

These toxic lenders are able to get away with this because there are enough naïve and greedy people out there that are addicted to gambling on penny stocks. Long term 99.99% of these stocks will fail but just like playing a slot machine there is someone that hits a jackpot and that greed of making millions keep us trading and playing these penny stocks. These stocks always go down long term. Where you can make money is realizing that these stocks will have to bounce and go up in order to sucker people into buying them. That excitement and feeling of missing out on a 500%-20,000% bounce or pump is what draws more investors in.

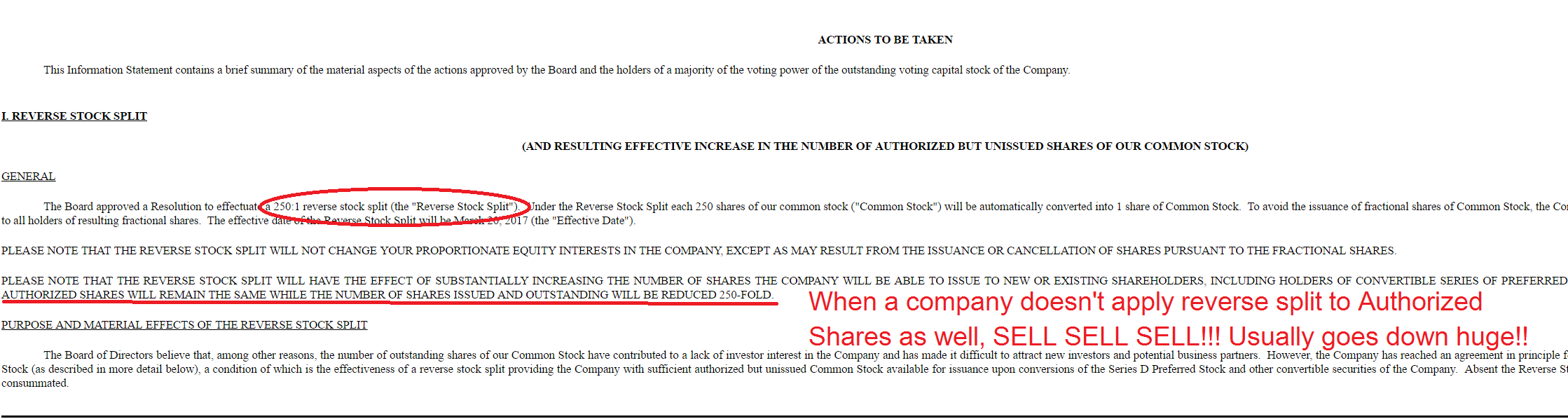

Now let’s take a look what a reverse split looks like. This is taken from a Pre 14(c)

The company is voting on a 250-1 reverse split. This means that if you own 250,000 shares of common stock at $1 You will now own 1,000 shares but the stock price will go up to $250 a share. The scary thing here is that the company didn’t apply the reverse split to the Authorized shares. They most likely plan on diluting the stock value. It is not uncommon to see a penny stock have a reverse split and drop 90% in 1-2 months. Reverse Splits cause huge sell offs. Generally as soon as you see a vote for a Reverse Split you want to sell and get out of the stock ASAP.

The company is voting on a 250-1 reverse split. This means that if you own 250,000 shares of common stock at $1 You will now own 1,000 shares but the stock price will go up to $250 a share. The scary thing here is that the company didn’t apply the reverse split to the Authorized shares. They most likely plan on diluting the stock value. It is not uncommon to see a penny stock have a reverse split and drop 90% in 1-2 months. Reverse Splits cause huge sell offs. Generally as soon as you see a vote for a Reverse Split you want to sell and get out of the stock ASAP.

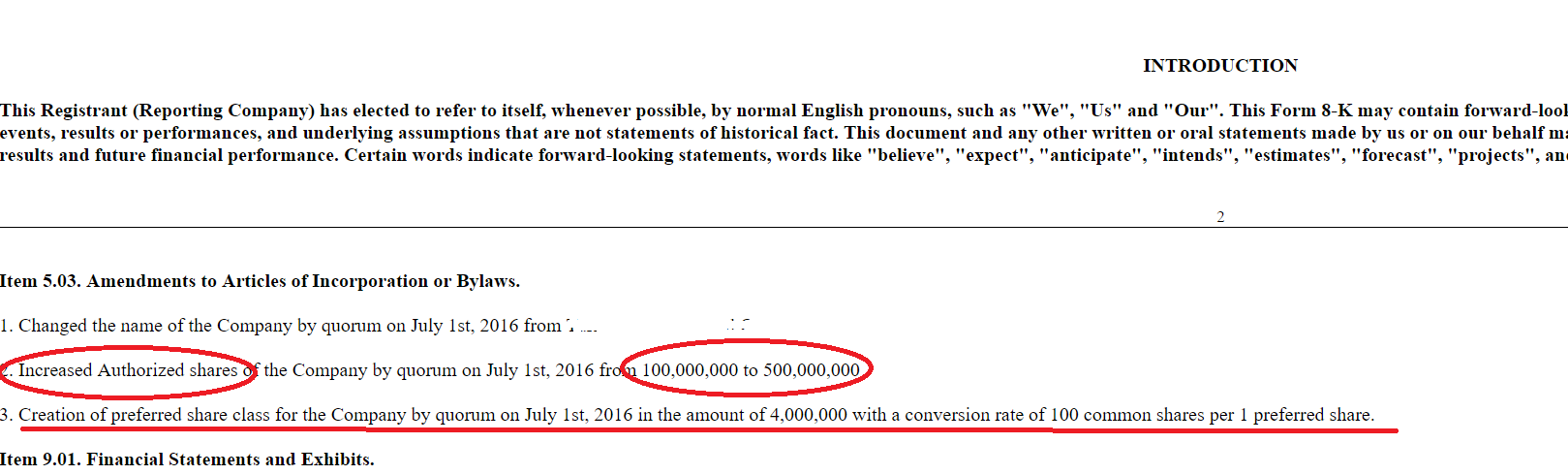

This company is raising the Authorized Shares by 5 times what they were and on top of that they are creating a new class of preferred stock that converts into common shares. This will surely lead to huge sell offs down the road.Now not all SEC Filings are bad obviously. Some 8K filings will have good news like a company uplisting or announcing business acquisitions.