(OTCMKTS: BVTK) Bravatek Solutions Inc.

Before we get started with my opinion on BVTK, understand everything I write here is just my opinion and is just for entertainment purposes. I don’t own any shares of BVTK I am not short on BVTK. Penny stocks are high-risk high-reward investments so only invest what you can afford to gamble with. Please read our disclaimer here. I will do my best to detail out some of the pros and cons about BVTK to be as unbias as possible. Regardless of what I write there will always be those that disagree with what I say. Make sure you do your due diligence and make your own buying and selling decisions.

If you haven’t heard of BVTK, you may be living under a rock. They have one of the most passionate followings similar to that of ELED. They are very active on Twitter, Ihub, and social media. I recently stirred up the pot a little on Twitter with some of the BVTK stock enthusiasts. Here are some of the back and forths.

My twitter feed was being blown up by some of the bought Twitter accounts that are promoting BVTK, so I decided to have some fun with them. It started with me tweeting out this:

Twitter handle @katerinaKennedy was pretending to be a hot female who had a passion for stocks. The truth is it was a bought account that had stolen the pic of an adult entertainment model named Veronika Black and cropped out the cleavage only showing the face in the twitter pic. The army of BVTK Twitter accounts started on the attack and the fake Twitter account of @katerinaKennedy later blocked me to avoid having more people know that the profile was a fake. Plenty of them started commenting with the #fakenews hashtag and calling me any names they could. After a few back and forths, BVTK ended up going up 30% that day but that bounce was short-lived, and just a couple weeks later it went from .0035 a share down to .0004 share.

I had a new trader write me trying to pump BVTK, and so I decided to stir up the pot again.

BVTK promoters/marketers have several Twitter accounts that they bought in bulk in help spread the word about BVTK. I was giving them a hard time because they got lazy and didn’t delete the back history on these accounts. Accounts like these are created so one person can control several different accounts and make it look like several people are excited about a stock. The more excitement a stock appears to have the easier it is to draw in new investors. After these tweets, the extremely passionate borderline crazy fans of BVTK came out. Here is a screen shot of one the post.

I do admire the creativity. The person took the time to go through 3 years of my facebook photos find one where I ran an ugly sweater charity event for children, and then crop the picture and turn it into a meme. I admire the passion and trying to discredit me may help some of the investors in BVTK ignore what I have to say. So instead label this behavior as creepy or crazy we will just assume this person is extremely passionate.

So with all the fake Twitter accounts and all the pumping going on with BVTK you must be thinking that I am going to say it is a stock to avoid right?

You guessed wrong! I believe all these are a form of marketing. So many penny stock companies are dead and dull. They don’t have loyal and active followers. BVTK has a group of motivated and enthusiastic people spreading the word about that stock. I believe this to be a great thing! BVTK is also doing an excellent job of targeting specific demographics. They are targeting conservatives and Trump supporters. I think this is genius marketing. Trump shocked everyone and crushed Hillary Clinton to become the president. He did it by strategically targeting the right demographics( it also helped that Hillary was clueless). BVTK is spreading stock awareness by doing the same thing. They are repeatedly shutting up negatively by calling people bashers and using the hashtag #fakenews. When people working together run into adversity or negative responses, they become stronger and more passionate. You see that with BVTK. So all the pumping and fake profiles are great marketing.

Why are people excited about BVTK?

Bravatek Solutions, Inc. is a high technology security solutions provider which assists corporate entities, governments, and individuals, in protecting their organizations against errors, as well as physical and cyber attacks.

Encryption technology and the ability to protect against cyber attacks and hacking is one of the most important industries. It is an industry that will continue to have rapid growth. The world is expanding exponentially with smart devices, smart phones, smart watches, Cars that drive themselves, cryptocurrency, and nanotechnology. All of which will require advanced protection from hacking. Companies that can offer superior protection and lock down huge corporate and Government contracts could end up being Trillion dollar companies. The potential is enormous!

Bravatek had some notes come due in February, and that along with having a bloated share structure has caused the stock to suffer. A lot of investors believe that the notes could be close to being paid off. The notes and dilution caused the stock to plummet down to .0004 if that dilution is over then BVTK has a chance of going up a lot if more buying pressure comes in. BVTK has been quiet for almost a year, and investors believe that it could become active here soon. These events could be perfect timing for BVTK. Not only do you have political email hacks fresh on everyone’s mind but just today there were several coordinated Cyber attacks worldwide! The news of the attacks caused Bravatek’s share price to go up 70% in just a couple hours!

The Pros

- Bravatek CEO rumored to be friends with Donald Trump

- Bravatek Twitter account is active @bravatek

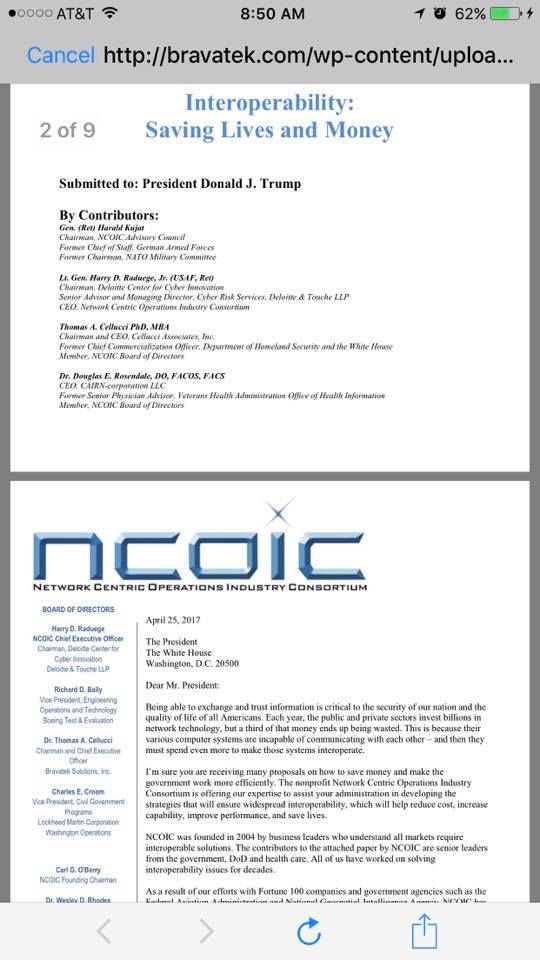

- Bravatek CEO Dr. Thomas Cellucci rumored to have visited the white house the day before Donald Trump signed this executive order https://www.whitehouse.gov/the-press-office/2017/05/11/presidential-executive-order-strengthening-cybersecurity-federal

- Dr. Thomas Cellucci wrote the book

“A Guide to Innovative Public-Private Partnerships: Utilizing the Resources of the Private Sector for the Public Good”

- Bravatek and Enterprise Sentinel formed a strong strategic alliance you can view how it works here http://www.esauth.com/attributes/how-it-works

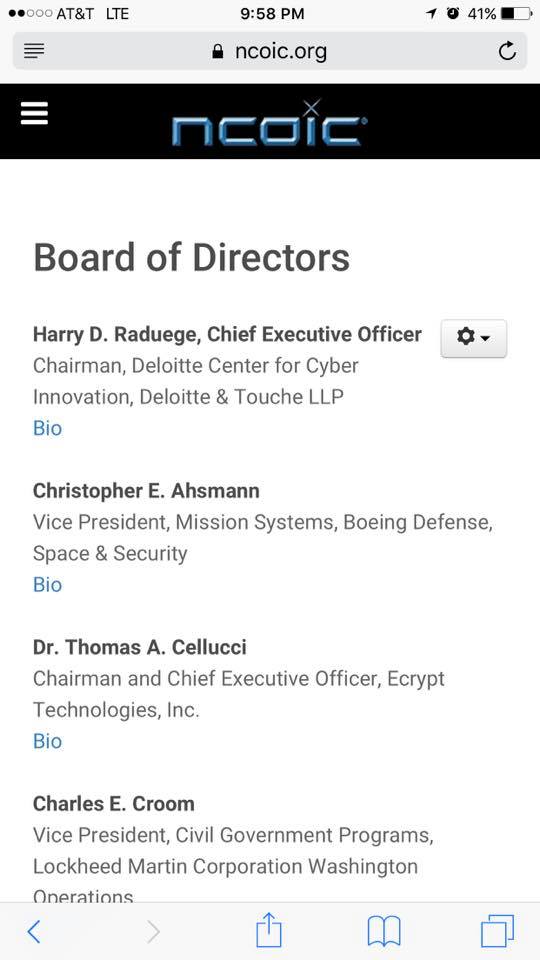

- Dr. Thomas Cellucci is the chairman and CEO of Cellucci Associates, Inc.

- Dr. Thomas Cellucci is the Director of Eurasian Economic Club of Scientists

- Dr. Cellucci is also the Director of California Molecular Electronics Corporation

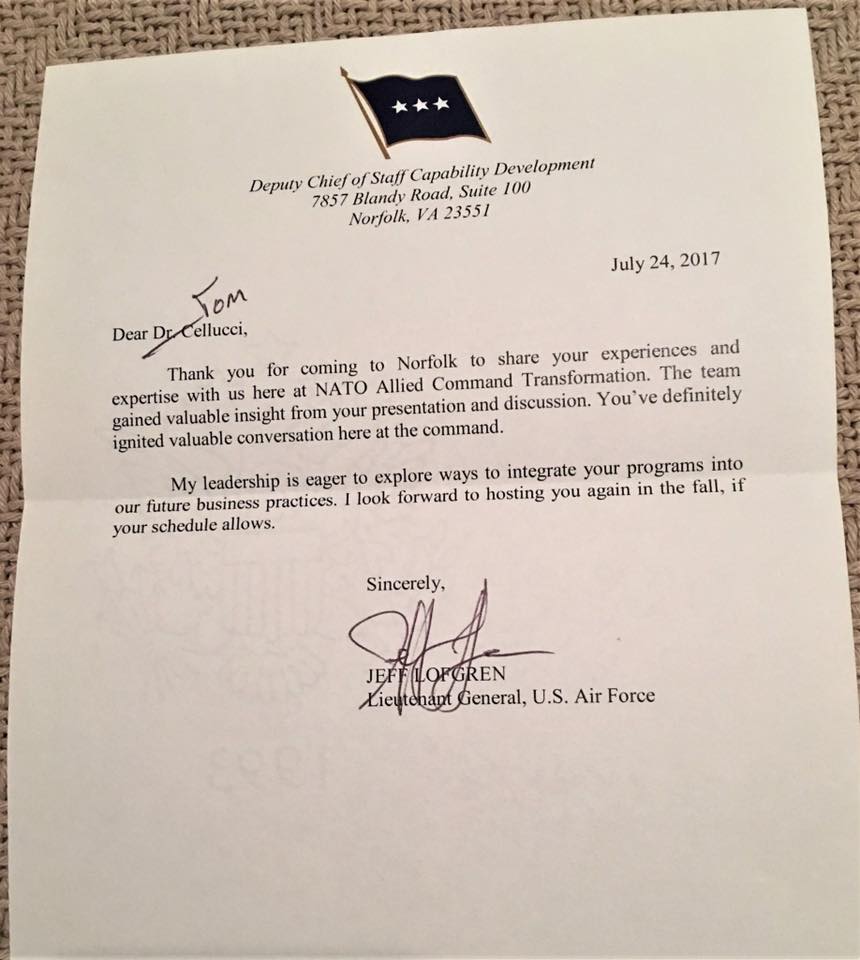

- Dr. Just recently spoke to NATO leaders at NCOIC event

- CEO has a degree in Advance technologies from MIT

- Rumored Government contracts in the works.

- May be done diluting

The Cons

- 10 billion Authorized shares. 3.5 Billion Oustanding shares.

- Bravatek has a history of hurting its loyal shareholders with reverse splits. Within the last year had a 2,500 to 1 reverse split. This action would be similar to taking $2,500 from a loyal shareholder and handing them $1 back.

- Could still have dilution ahead with convertible notes and Diluting Market Makers like VNDM on the ask.

- Company seems to have a difficult time staying current in its reporting

- The company has a history of rumors and PRs that never get backed up by profit gained in past financial statements.

As of 05/12/2017, the chart of BVTK does look good. It could be ready for another breakout.

August 11th update

BVTK is going stronger than ever. People who grabbed shares in the 000s have made a lot of money! There has been a lot of exciting things come forward about BVTK.

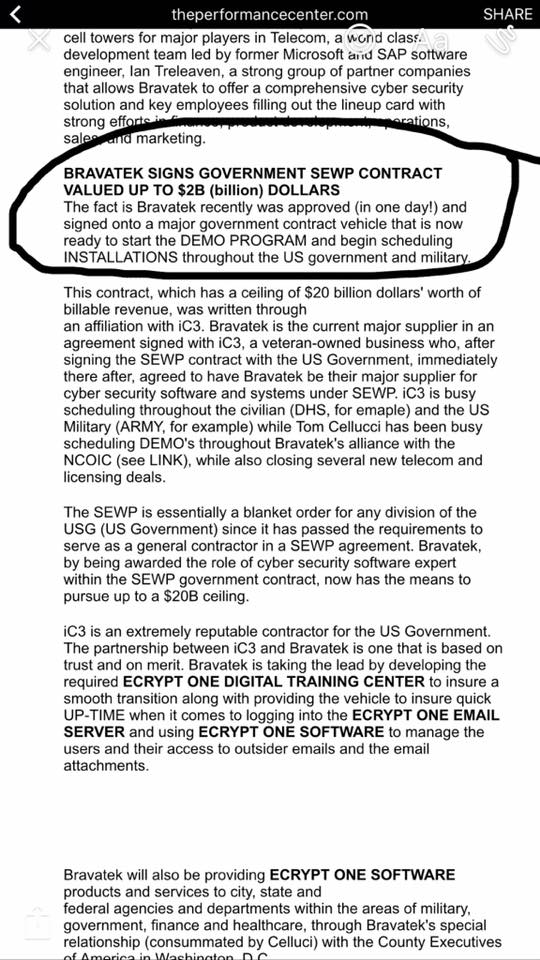

Here is some of the additional DD that was put together. This was put together by Nick Serrano.

This is a picture of Tom Cellucci (The CEO of BVTK) with NATO members

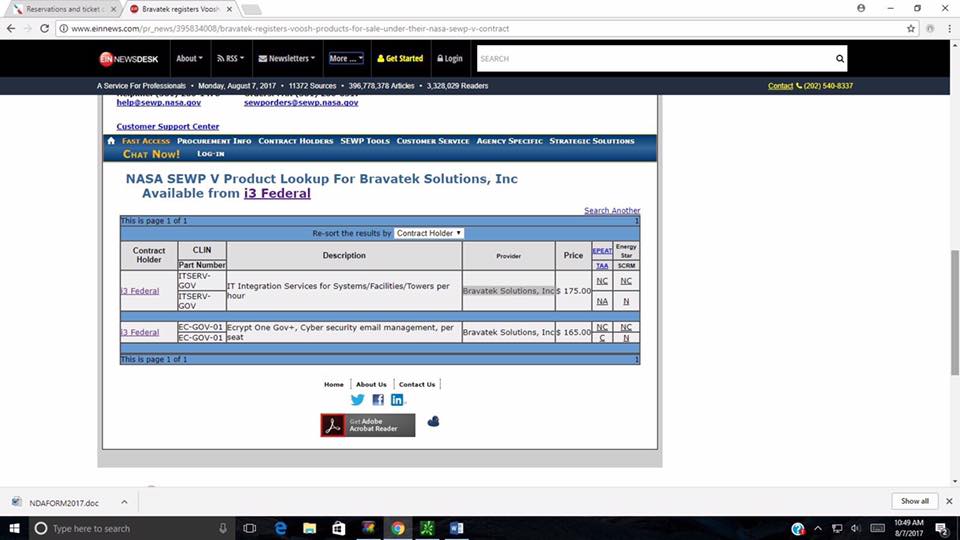

Can be seen at the sewp.nasa.gov site having contracts in place.

Here is a letter their CEO received from the Lieutenant General of the U.S. Air Force

Here is a link to a video of Tom Cellucci speaking at the 6th annual Security Summit.

Here is a link to a video of Tom Cellucci speaking at the 6th annual Security Summit.

Partnership with CrucialTrak

That is some of the DD loyal shareholders are finding. There is a lot to be excited about with Bravatek. Just remember that it is still a penny stock and penny stocks are always risky. The one potential red flag is that the outstanding share has gone from 3.5 billion to 6.768 Billion (as of August 11th) That is over 3 billion in dilution in the last 3 months. If there wasn’t that dilution the stock price would be a lot higher than it is currently at.

As you can see BVTK chart has been on a nice uptrend. There is a possible trade channel starting where you may see some people flipping from .0045-.006 but the chart still looks healthy. Volume has been down some. It is very important for BVTK to maintain its volume in order to maintain its uptrend.

This has just been an opinion piece. Everything here is just for entertainment only. Please make your own buying decisions.

Here are some of the Red Flags with Bravatek

As of BVTK’s latest 10K they only had $135 in cash. SInce May of 2017 Bravatek has taken out over 1 million worth of toxic loans. They have recently partnered up with Darkpulse agreeing to loan them Darkpulse 5 million dollars.

It seems a little fishy that @Darkpulse on Twitter was tweeting and pumping BVTK to shareholders. It also was strange that they were claiming Billion dollar deals in foreign countries but Bravatek never released any Press Releases for these deals. One has to ask the question if DarkPulse is as successful as they claim why are they having to borrow money from a penny stock company who is already in debt?

Back in 2015-2016 BVTK (known as ECRY at the time) was talking about some deals worth millions of dollars but never had any money to show for the deals. The company claims it had nothing to do with the pump and dump that happened in 2015-2016, however, press releases pumping deals that never came through were coming through the same time of the initial pump and dump. Listed down below is an example.

https://www.prnewschannel.com/2016/01/12/bravatek-executes-joint-venture-agreement-solidifies-telecom-project-purchase-orders-otcqb-bvtk/

A lot of the JV’s and what the company is doing now seems very similar to the past pump and dump. Unfortunately, Since Tom Cellucci has taken over as CEO the company’s stock value has tumbled. If an Investor that invested $10,000 and trusted in BVTK in 2015 would now have less than a penny to show for that investment. That is why some believe BVTK is once again scamming shareholders with false promises like it did two years. ago.

The biggest questions right now are if the company has 5 million dollars to load DarkPulse where did that money come from?

If Bravatek has that kind of cash why did they settle 1 million worth of debt for 6.2 billion shares in the last year? If they believed their company was valuable shouldn’t they have negotiated a better deal then less than .0002 a share? If BVTK believes its company to be so valuable why would they pay for HelpComm with 600 million shares if they had that kind of cash? Even more, pressing is why would BVTK take out over a million dollars debt in extremely toxic loans since May, most of which are valued at .0005 or 60% of the lowest stock price in last 20 days whichever is the lowest? It is not wise for companies that have millions of dollars to get toxic financing. Death Spiral Financing is usually reserved only for penny stock scams.

The most alarming thing with the HELPCOMM deal is this line “The Company will issue to the stockholders of Helpcomm 100,000 shares of a newly designated class of preferred stock, which preferred stock shall be non-voting prior to conversion into the Company’s common stock, and shall be convertible into 600,000,000 shares of common stock at the holder’s election so long as unissued, unreserved, and authorized common stock is available for issuance and such conversion will not result in the holder owning more than 4.99% of the issued and outstanding common stock at such time”

Owning less than 5% means that Helpcomm won’t have to file as an inside trader when they sell. What is strange is that the current Outstanding shares is at 7.5 billon shares. What that means that in order for Helpcomm to convert all of their shares the Outstanding shares will have to increase to a minimum of 12.1 Billion. The current Authorized share is at 10 million. That most likely points to BVTK having to do a reverse split in the near future.

The only cash BVTK appears to have on hand would be from the latest toxic loans. They have taken out roughly 1 million in toxic debt since May 2nd. That debt can be converted into shares and sold once BVTK comes current and the 6-month restriction is over. So you are looking at more debt being able to be sold starting Nov. 2nd (six months after the initial loan). Since it doesn’t appear BVTK has any cash on hand besides that which came from convertible notes it looks like they will have to borrow at least 4 million more just to be able to loan Darkpulse money. The only like scenario is that they go get more toxic financing. In order to get 4 million worth of loans for shares, they would have to increase their Authorized Shares. Right now, unfortunately, everything is looking to be the exact same pattern that happened in 2015. Back then they did a 2500 to 1 reverse split and then raised the Authorized Shares from 5 billion to 10 billion crushing shareholders.

If Bravatek has money through a deal they have worked out, it would be very nice for them to release an 8k like they are required to show they have actually made money from the deals.

Unfortunately, Bravatek agreed that toxic note holders can convert debt at any time. Which makes it almost impossible for Bravatek now to arrange a share buyback. Toxic lenders can simply say no we would like to convert our shares and BVTK is out of luck.

Bravatek is also starting to see millions of dilution from non-retail market makers VNDM and BMIC. There is usually 20-30 million each day in T-trades that the market makers took their time on reporting. If we are to speculate the millions a day worth of dilution is from the 6.2 billion shares that were settled. Leaving billions of shares still to be sold off into the float. Bravatek shareholders have put a lot of energy into spreading the work on their stock. They have reached out and told family members and friends. Their hard work has been able to battle dilution so far. If BVTK wasn’t diluting this stock might be at .10 a share. Unfortunately like all cult following stocks eventually longs run out of money. They also run out of people they can convince to buy shares. Once this happens dilution starts to win the battle. It starts a chain reaction and you have the potential to see massive selloffs.

Be very careful if you choose to trade this stock.

If/when the reverse split happens you will see massive selloffs. You will most likely see pumpers trying to convince naive longs that the Reverse Split was only so BVTK could go to Nasdaq. BVTK doesn’t come close to meeting Nasdaq requirements and would need to maintain those requirements once achieved for at least 3 years.

Disclaimer: Everything in this article was for entertainment purposes only and just our own opinion. We do not own any shares of BVTK and We have never owned shares of BVTK. We have not and will not short BVTK. We have no intentions of ever buying BVTK shares even if there is a massive selloff. We encourage new traders to read our free training and sign up for our penny stock alerts.