Bemax Inc. (OTCMKTS:BMXC) Feb 08 2017

Bemax Inc has been on fire lately and its shareholders are excited! BMXC is in the business of selling disposal diapers. Not just nay type of diapers though. Their focus is on Chlorine free green diapers. The diaper business is a multi-billion dollar business. Green diapers are a growing trend over the last few years with the united states starting to push more into being Eco-friendly. Some experts predict that the baby diapers market will grow to 64.62 billion by 2022. It is expected to reach 52.2 billion in 2017. According to Bloomberg many companies are also making a move towards adult diapers. BMXC hopes that being targeted on Green Chlorine Diapers will be a targeted niche that will have a big future.

Are shareholders really this excited about diapers? Maybe… but there are other reason to be excited. In the last two months BMCX has went from .0029 a share to where it is at now which is .03 a share. Any skilled (lucky) investor that put 5k in the stock just a couple months ago would have seen that money turn into 50K.

As you can see BMXC is still in a great uptrend right now. Its RSI is just over 67 so it still has some room to go up. You will still want to make sure it stays inside the trading channel and it is safe to have a stop loss in place if support falls through.

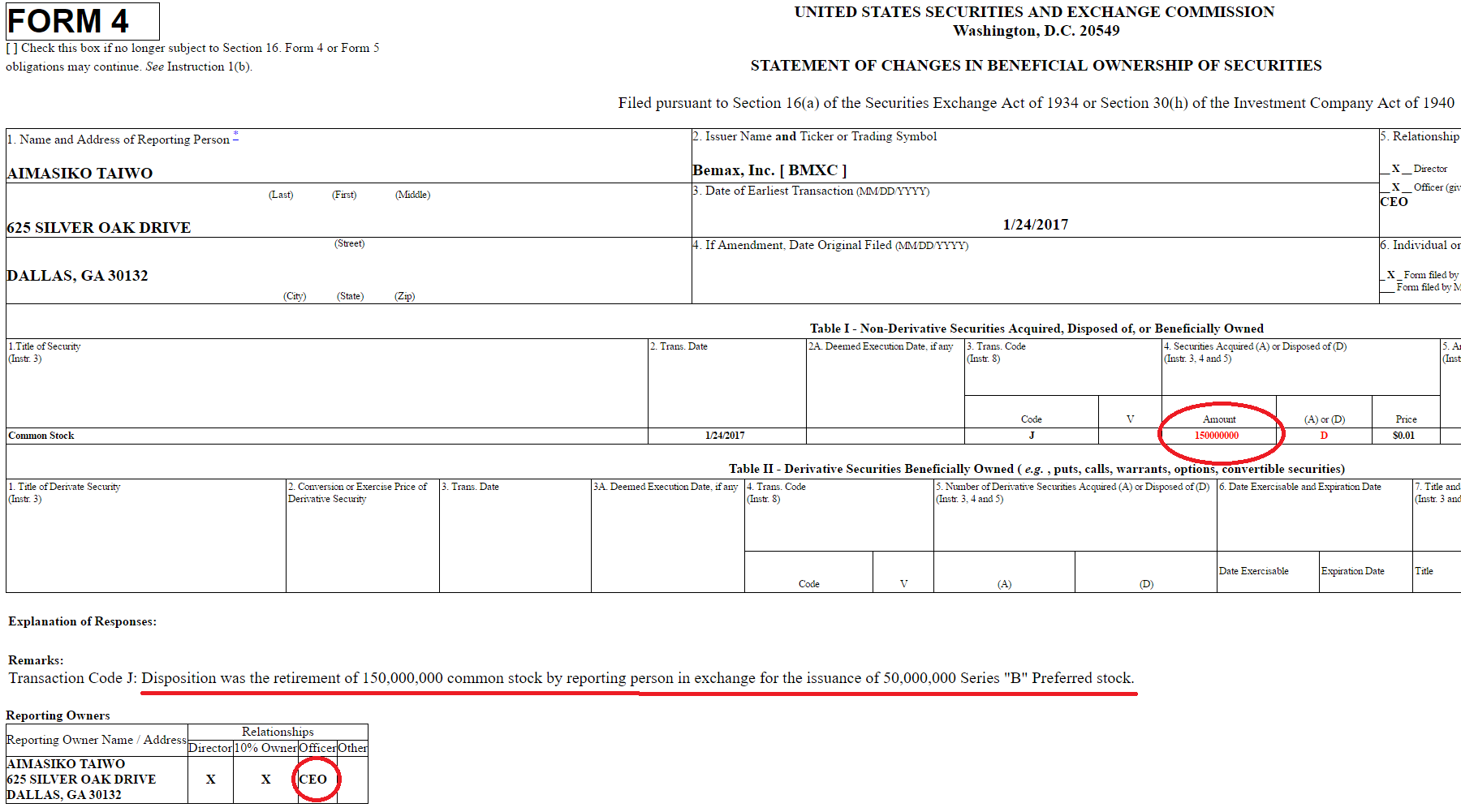

Above is a pic of their recent Form 4 that was filed. The CEO Aimasiko Taiwo retired 150 million of her common stock she owned. It is always good to see a CEO retire common shares in exchange for Preferred Stock. These preferred shares can not be converted for a full year after they have been issued. This now leaves the Common Outstanding shares at just over 300 million.

Above is a balance sheet from the last reported 10-Q. The current assets has dropped significantly over the last quarter. As of Nov. 30th of 2016 Bemax Inc. only had 14,454 of assets. According to the balance sheet they had $356,306 of current liabilities of which 298,746 were Convertible loans. This is a reason for concern since over the last quarter the company added over 100k of new debt and liabilities and saw their assets go down by over 100k. If I were a shareholder I would definitely reach out to management and ask them where the money has gone.

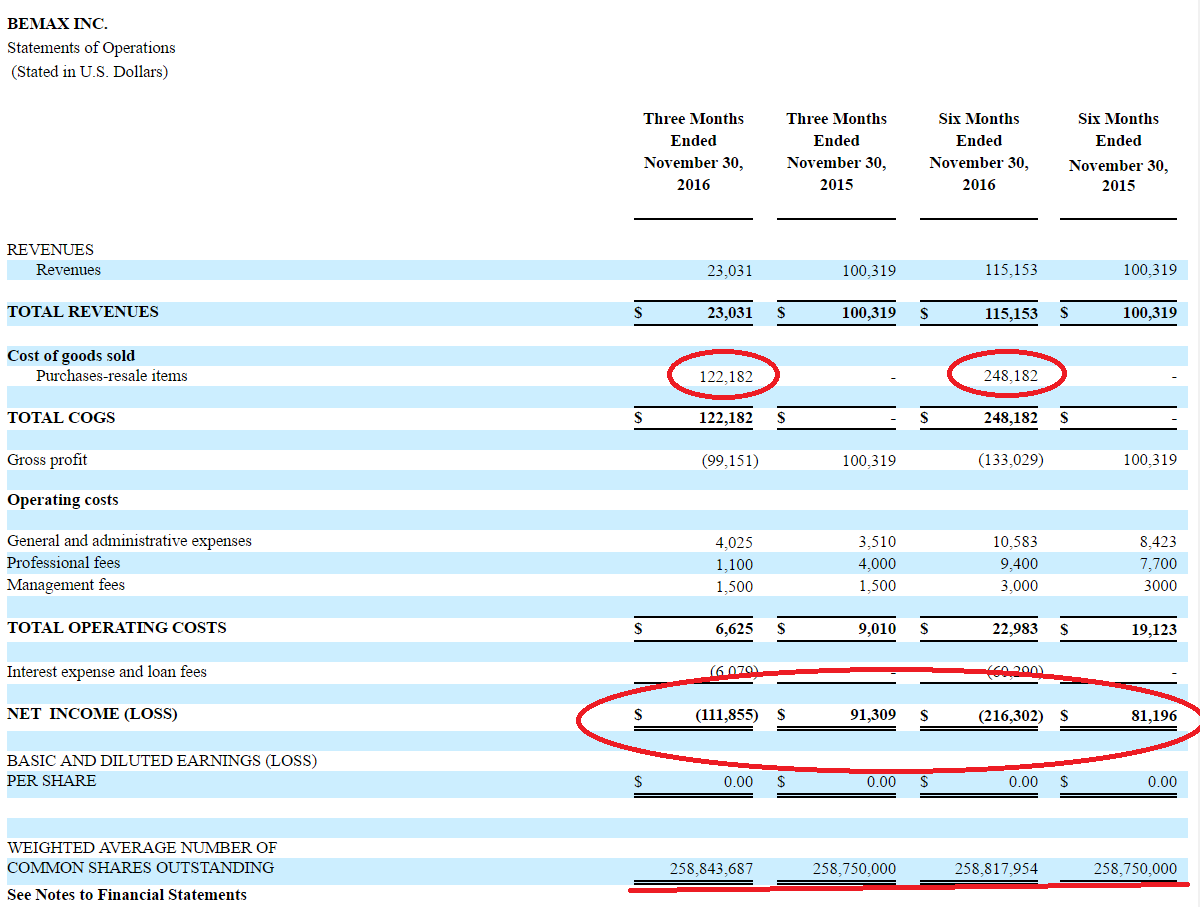

Here is the statement of operations for BMXC. The revenue was down a lot last quarter. Dropping from $100,319 to $23,031. The cost of goods sold was 122,182 which show a loss of 99,151. However if you look back at previous quarters it looks like they may load up on goods/resale items at one time. If this is the case then you should see positive revenue on the next financial statement. Using this theory and looking at the Net Income we can speculate that the next financial report may be their best net income yet. There are a few more positive things on this statement. The low general and administrative expenses. A lot of penny stocks have greedy Administrators and CEOs that pay themselves a lot of money even though their company is not doing well; $6,625 is a very low number for Total operating cost for a quarter compared to most. It is also promising that BMXC’s outstanding shares have stayed pretty much the same over the last year.

In conclusion there are a lot of positive things about BMXC but also some things to be cautious about. The stock currently has a 9 million dollar market cap. If you look strictly at finances that would mean that Bemax Inc. is extremely over priced given that is only has $14,954 in assets and $356,306 in liabilities. This is a penny stock though. People invest in penny stocks base on the possibility of the company gaining some momentum and becoming the next monster energy and making its shareholders rich. The company has a very profitable niche. The company is selling products on Amazon. The CEO seems to truly believe in this company and is willing to retire her shares and take very minimal pay. The chart is on a great uptrend and there is a good chance in my mind of favorable financial coming out soon. Let me know what you think. If you like this article share it. If you hate it share it and tell me how dumb you think I am. Don’t forget to sign up for our free alerts and free penny stock watch list.

Disclaimer: I do not own any shares of this BMXC. I am not paid to talk about BMXC. Everything in this article is just an opinion and for entertainment purposes only. Make your own buying and selling decisions. Make sure you check out our free penny stocks training.

Good article. You left out the part where she up dated her revenue guidance for $3.5 million to $4.5 million for 2016 as well as a recent reporting of a $1.1 million sale. This stock was a dollar last May on the possibility of a deal with Amazon which is now a reality. Share structure was virtually the same! This year we won’t be stuck at a dollar! At .03 a share,,, Don’t hurt your self getting in,,, LOL

Thanks, yes the 1.1 million dollar sale was huge news for the company.