On Wednesday, Shares of Allied Motion Technologies, Inc (NASDAQ:AMOT) traded at $20.44 by gaining 1.34% with price volatility of 5.84% for a week and 4.89% for a month plus price volatility’s Average True Range for 14 days was 1.00 and its beta stands at 1.80 times.

Stocks after opening at $20.25 hit high price of $20.69 and on last session stock held volume of 78,423 shares which was unexpectedly lower than its average volume of 102,677 shares.

A U.S based company, Allied Motion (AMOT: NASDAQ), designs, manufactures and sells precision and specialty motion control components and systems used in a broad range of industries within our major served markets, which comprise the Vehicle, Medical, Electronics, Industrial, and Aerospace and Defense. Recently the company stated financial results for the fourth quarter and year ended December 31, 2015.

“We made great progress in 2015 advancing our strategy to leverage our expertise in electro-magnetic, mechanical and electronic motion technology to create fully-integrated motion control systems for our customers that are innovative, cost effective, custom-engineered solutions which can outpace what the competition has to offer,” commented Dick Warzala, Chairman and CEO of Allied Motion. “We continue to invest in engineering and development, which we believe is core to our future growth. And, while demand across a number of our end markets was down, the effectiveness of our Allied Systematic Tools drove operational efficiencies and assisted to offset the effect of lower volume.”

Fourth Quarter 2015 Review

Revenue for the quarter was $50.8 million contrast with $61.9 million in the 2014 fourth quarter, which reflects the impact of sluggish demand in a number of the U.S. target markets, particularly in the Vehicle market, which practiced order push-outs and delays from the fourth quarter of 2015 into 2016. Not Taking Into Account the unfavorable effects of foreign currency exchange (FX), fourth quarter revenue was $53.2 million, an $8.7 million, or 14.0%, decline from the prior-year period.

Sales to U.S. customers were 65% of total sales for the quarter, a decline from 67% for the same period last year, with the balance of sales to customers primarily in Europe, Canada and Asia.

Gross profit was $14.3 million, or 28.2% of revenue, contrast with $18.2 million, or 29.3% of revenue, in the 2014 fourth quarter. Operating income was $2.5 million for the quarter and comprised $0.6 million in acquisition-related costs. Not Taking Into Account those costs operating income was 6.1% of revenue. Operating income was $6.8 million, or 11.0% of revenue, in the fourth quarter of 2014. Allied Motion continues to invest in engineering and development (E&D) for new product development, much of which is application specific. E&D as a percent of revenue was 7.3% in the 2015 fourth quarter contrast with 6.0% of revenue in the same period the prior year.

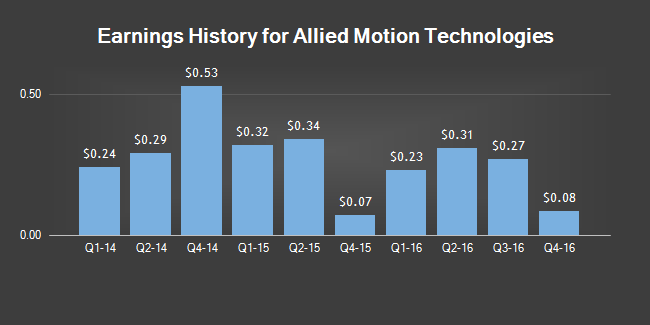

Net income was $0.7 million, or $0.07 per diluted share, for the 2015 fourth quarter contrast with $4.9 million, or $0.53 per diluted share, for the prior-year period.

Fourth quarter earnings before interest, taxes, depreciation, amortization, stock compensation and business development expense (“Adjusted EBITDA”) were $5.5 million contrast with $9.4 million in the fourth quarter of 2014. The Company believes that, when used in conjunction with measures prepared in accordance with U.S. generally accepted accounting principles, Adjusted EBITDA, which is a non-GAAP measure, assists in the understanding of its operating performance.

Full Year Review

Revenue reduced by 6.9% to $232.4 million contrast with $249.7 million last year. Not Taking Into Account the unfavorable effects of FX, revenue in 2015 was $247.8 million, a $1.9 million, or 0.8%, decline from the prior year. Electronics and Medical market sales assisted to offset lower demand from the Vehicle, Industrial and Aerospace and Defense markets.

Sales to U.S. customers were 66% of total sales for the year, which remains unchanged from last year, with the balance of sales to customers primarily in Europe, Canada and Asia.

Gross profit was $68.8 million, down $4.7 million on lower revenue. However, as a percentage of revenue, gross margin expanded 20 basis points to 29.6%, primarily due to mix, the continued shift to more solutions-oriented sales and the application of Allied Systematic Tools to drive efficiencies and drive down production costs.

Operating income for 2015 was $20.9 million, or 9.0% of revenue. Operating expenses comprised $0.6 million in acquisition-related costs formerly mentioned and continued investment in E&D for the development of new products and solutions for customer applications. E&D as a percent of revenue was 6.1% in 2015 contrast with 5.6% of revenue in 2014. Operating income in 2014 was $24.2 million, or 9.7% of revenue.

Net income was $11.1 million, or $1.20 per diluted share, contrast with net income of $13.9 million, or $1.51 per diluted share, in 2014.

Full year Adjusted EBITDA was $31.2 million contrast with $33.9 million for 2014.

Short-term as well long term investors always focus on the liquidity of the stocks so for that concern, liquidity measure in recent quarter results of the company was recorded 2.10 as current ratio and on the opponent side the debt to equity ratio was 1.11 and long-term debt to equity ratio also remained 0.96.

As the owner ship concerns stock institutional ownership remained 37.30% while insider ownership included 38.22%. The share capital of AMOT has 9.29 Million outstanding shares amid them 192.50 Million shares have been floated in market.

For investors focus on the performance of the stocks so the AMOT showed weekly ahead performance of 3.18% which was maintained for the month at 28.63%. Correspondingly the negative performance for the quarter was remained 3.72% and if took notice on yearly performance that was 20.62% whereas the year to date performance halted at 21.93%.

Strong Cash Generation and Balance Sheet Support Growth Strategy

Cash generated by operations was $20.1 million in 2015. Cash from operations supported organic growth initiatives, counting $4.7 million in capital expenditures. Capital expenditures are predictable to be at similar levels for 2016.

Cash and cash equivalents at 2015 year end were $21.3 million.

Total debt was $68.8 million, down from $74.8 million at December 31, 2014, reflecting $1.9 million of debt repayments during the quarter and $6.0 million during the year. Debt, net of cash, was $47.5 million, or 42% of net debt to capitalization.

Conference Call and Webcast: The Company will host a conference call and webcast on Thursday, March 10, 2017 at 11:00 AM ET.